In the past 5 years, there have been many startups engaged in the online loan business. In terms of business, this business model will certainly bring profit in a short time. By relying on the amount of interest that must be paid by users of online loan applications. In addition, the rise of online loan applications makes it very easy for users. Because through the device we use, we can directly apply for online loans with terms that can be said to be quite easy and practical.

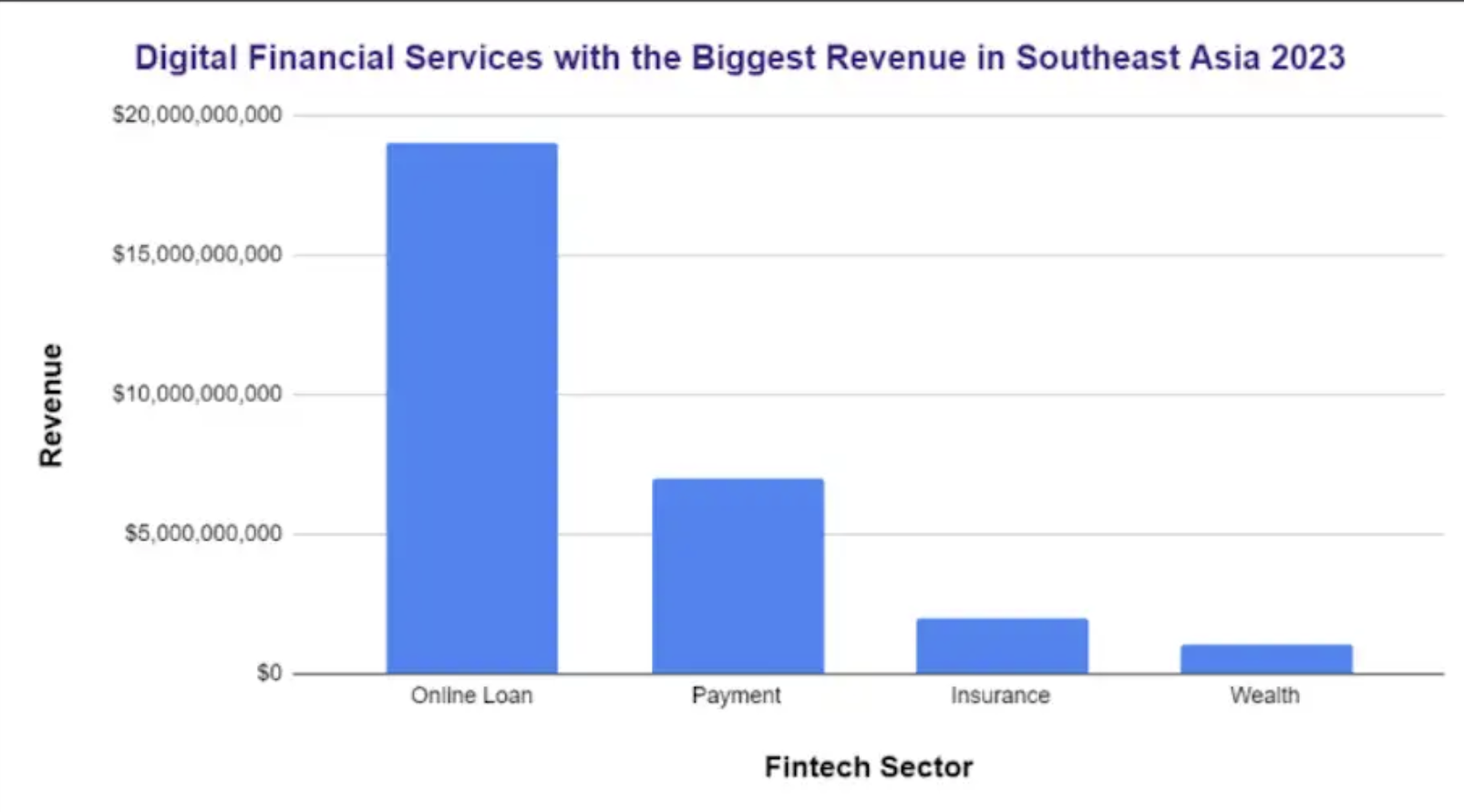

This shows how promising the business is. Based on data from Google, Temasek, and Bain & Company, online lending services will be the largest revenue-generating digital financial service in Southeast Asia by 2023 with revenues reaching US$19 billion.

Source: Google, Temasek, and Bain & Company (2023)

Therefore, it is not surprising that many of our closest friends, family, and relatives use online loan applications. Actually, everything will be fine if online loan application users can be responsible for paying instalments. The problem is when we neglect to pay off our “debts”. Stress, depression, and suicide can be the steps taken if you are unable to pay off your debt. Especially, in large amounts. Apart from affecting ourselves, debt collectors will also terrorise our family, relatives and closest friends if we fail to fulfil our responsibilities.

There are many solutions that we can do before we get trapped by online loans, especially preventive measures such as budgeting to match the expenses and income we have. A simple practice that can be done is to use the concept of 40 30 20 10. The explanation is that 40% is the budget for daily needs, 30% for debt needs, 20% for investment and savings, and 10% for social needs. In addition, from a psychological perspective, in order to avoid being tempted by online loan application offers and making irrational decisions, we must adjust our lifestyle to the income we have. We must fulfil our needs in moderation and not become consumptive, such as FOMO to certain circumstances or conditions so as not to make impulsive purchases.

However, if you have a budget that has been prepared and can commit to yourself in making instalment payments. There is no problem if you use an online loan application. Most importantly, we must think logically and rationally so as not to enjoy for a moment, miserable forever.